Edward Jones Credit Cards has been issued by the Elan Financials. You can categorize this card as a store card, travel card, as well as a shopping card. The company provides credit cards, debit cards, regional & national network access, ATM services, and payment solutions. You will get investment services to individuals of all sizes and small businesses.

Types of Credit card:

- Edward Jones World MasterCard

- Edward Jones Platinum MasterCard

- Edward Jones World Plus MasterCard

Edward Jones Credit Card features:

Advantages:

- You don’t have to pay any Annual Fee for all three cards.

- You will get the capability of earning rewards for every dollar you spend.

- Get welcome offer is 10,000 bonus points.

- Pay 0% Annual Percentage Rate on Transfers in the first 12 months.

- Get 15,000 loyalty points after you spend $1,000 in the first 90 days of account opening.

- You can deposit your cash back rewards into another Edward Jones account.

- Earn points for every $2 spend on up to $40,000 and 2 points on every $1 spent over $40,000.

- Redeem your points through cashback, travel rewards, charitable rewards, and gift cards.

- Get Travel accident insurance.

- Fraud Protection is available.

- Bank will provide personal advisors for commercial purposes.

- Easily pay your bills and settlements through the online account.

Disadvantages:

- Pay $40 Late Payment fee.

- Pay an investment fee unless your portfolio greater than $2.5 million.

- You will need to pay several fees every year.

- Not excellent platform for Trade Security activities.

- Advisory services are limited to investment options.

Fees and Charges:

- Cash advance fee: 5% (min $10)

- Cash advance APR: 26.24% (V)

- Late payment: Up to $41

- Max Overlimit fee: $0

- Foreign transaction fee: $0

- Balance transfer APR: 15.24% – 26.24% (V)

- Purchase APR: 15.24% – 26.24% (V)

- Grace period: 24 days

Needed credentials to activate Edward Jones credit card:

You will need these below-mentioned things to activate this credit card.

- First and last name

- Email address

- Birthday

- Address

- Phone number

Through phone calls:

If you don’t have any Wi-Fi and still want to activate your card, then you can follow these steps to activate your card.

- Switch on your Phone.

- Then dial the number back of your card.

- Follow the instructions to easily activate your Edward Jones credit card.

Also Read:

How to Access Elan Credit Card Accout at www.myaccountaccess.com

Apply for Wawa Credit Card Online

Manage your Sears Credit Card Online

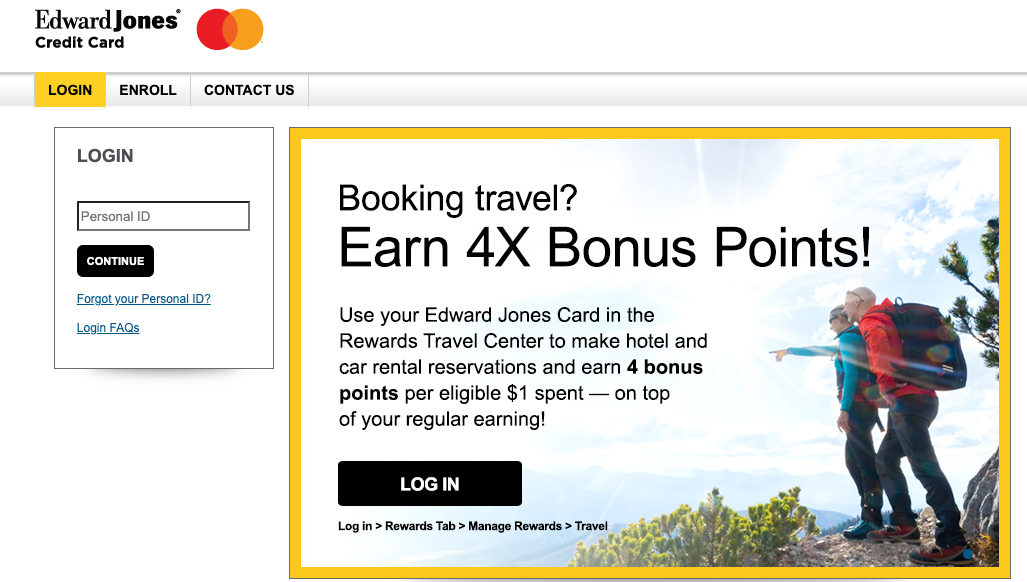

Edward Jones Credit Card Log In:

- First Launch your web browser (Chrome or Safari) on the laptop or computer.

- Then you will need to navigate to www.edwardjonescreditcard.com

- Then enter the ‘Personal ID’ option there.

- There provide your passcode and the requested characters of your memorable word.

- Then tap on the ‘Continue’ when you’re ready.

- For an extra security check, you may be asked for your card details.

- Enter the one-time security code on your computer once you get it.

- Finally, tap on ‘Login to Online Banking’ to continue.

Edward Jones Credit Card Password Recovery:

If you’ve forgotten any of your login details, then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- First, navigate to the Edward Jones credit card activation page www.edwardjonescreditcard.com

- Tap on the “Forgot your personal ID?” link.

- A new page will appear.

- Verify your account on that page.

- Enter the last 4 digits of your SSN, DOB in the DD/ MM/ YYY format, and Account Number there in the given place.

- Finally, tap on the “Submit” button.

- You can retrieve your username or password easily.

Edward Jones Credit Card bill Payment:

You can use the Edward Jones credit website or mobile app for making Edward Jones credit card payments online. You can also pay by phone, through the Edward Jones credit mobile app, by mail, or at a branch.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- Log in to your Edward Jones Credit Card account online.

- You can also launch the Edward Jones credit card App on your mobile device.

- There choose “Payments” from the main navigation menu.

- Select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- Choose the “Add a bank account” option there and provide your account details.

- Follow the on-screen instructions and “Review and Verify” to confirm the details of your payment.

- Finally, tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment by selecting a Repeat payment option.

Payment through mail:

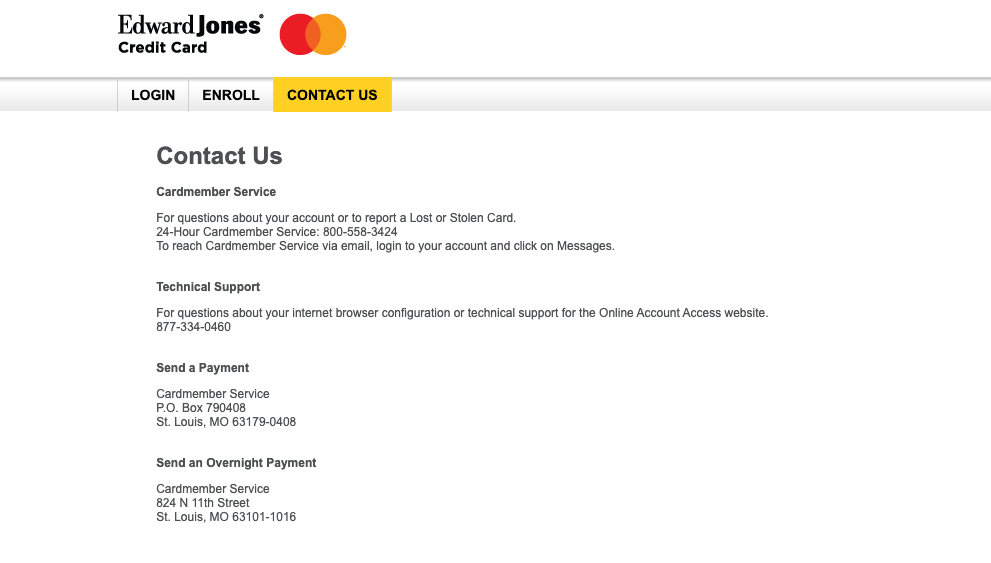

If you want to use a check or money order but not cash, you can mail your payment in to Edward Jones credit cards. Put your card number on the memo or note field of your money order or check so the company applies it to the right account. You must be sure to send it early enough that it will arrive by the due date. Mail it to,

Cardmember Service

P.O. Box 790408

St. Louis, MO 63179-0408

Overnight payment:

Cardmember Service

Attn: 790408

824 N 11th St.

St. Louis, MO 63101-1016

- Call In payment:

You can make Edward Jones Credit Card payment by phone using a checking or savings account which requires calling the number on the back of your card to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during a call and will ask for the last four numbers of your Social Security number to check that you’re the right card member.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Lock your Edward Jones Credit Card:

You can instantly lock and unlock your Edward Jones credit Card if lost or misplaced to prevent it from being used for purchases from its mobile app. You must follow these few simple steps.

- Open your Edward Jones credit card mobile app first www.edwardjones.com

- Log in with your credentials.

- Select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- Change the settings so that your card is in a locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

- Navigate back to the Secure Hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is the customer support which will help you 24 hours a day, 7 days a week.

- First, open a browser of your choice.

- Visit Edward Jones credit home page at www.edwardjonescreditcard.com

- You will need to scroll down to the bottom of the page.

- Then locate to select the Contact US option.

- After locating the Customer Service option, you’re now required to tap on Contact Us.

- After visiting the next screen, a couple of different assistance options will be displayed on-screen to seek help for the query or concern you’re looking to solve.

- For any further assistance, you must click on the See All option under Edward Jones credit card.

- Finally, you can find assistance for your concerned query through the different support options available.

You can call 800-558-3424 to reach their customer executives.

FAQ:

Q: How do Edward Jones advisors get paid?

A: Edward Jones financial advisors are primarily compensated on a straight commission basis. You can pay by selling customers financial products that generate commission revenue to the firm and themselves.

Q: Is Edward Jones a good company?

A: Edward Jones is a well-known full-service brokerage firm which can work well for large due to the combination of competitive advisory fees and professional investment management. You can pay heavily in annual fees, compared with other, cheaper options.

Q: What is the minimum credit score to be eligible for an Edward Jones Credit Card?

A: Anyone with a 620 score can apply for this card.

Q: How can you activate your Edward Jones credit card?

A: Click here to access the ” my Edward Jones credit Card ” page, then click on the black “Activate Card” button. After that on the “Edward Jones credit Card Verification” page, you can submit your information to activate your card so you may begin shopping!

Q: Can you activate your card via phone?

A: Yes, you can. For that, you need to get the correct number. You can dial the number on the back of your card to activate your card easily.

Q: What are the top benefits of an Edward Jones credit card?

A: There is a number of benefits that every cardholder can avail. Some of the advantages are,

- $0 Annual Fee

- $0 Fraud Liability

- EMV Chip Security

- Online & Mobile Account Management

- 24/ 7 ATM Cash Access

Reference: